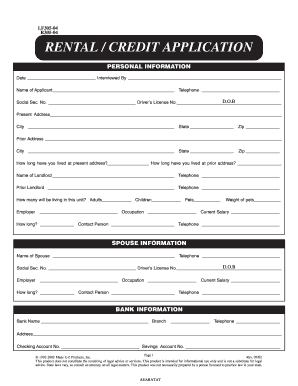

Get the free RENTAL / CREDIT APPLICATION

Show details

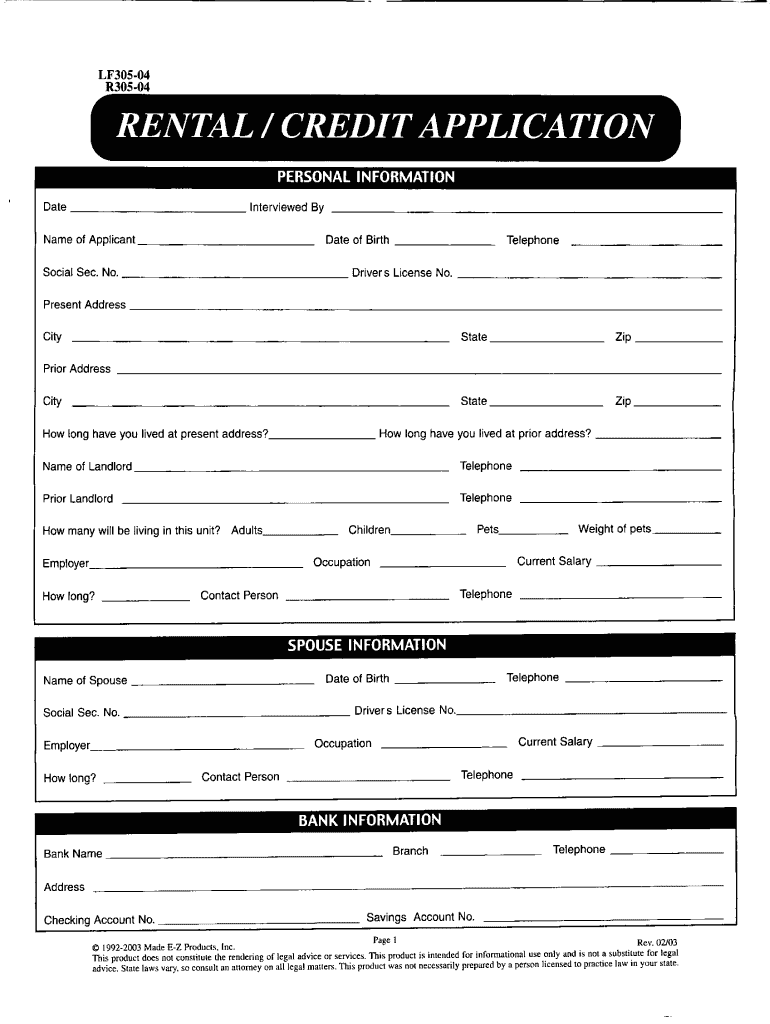

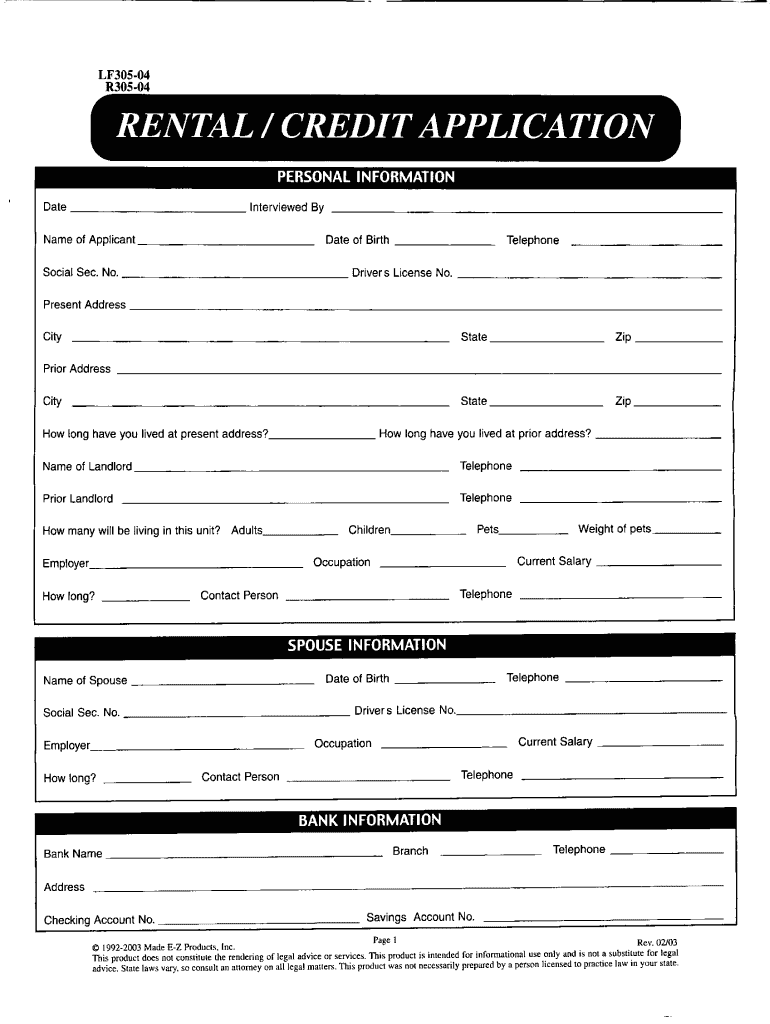

LF30S-04 R30S-04 RENTAL / CREDIT APPLICATION PERSONAL INFORMATION Date Interviewed By Name of Applicant Date of Birth Social Sec. No. Telephone Driver's License No. Present Address State Zip State

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your rental credit application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rental credit application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rental credit application online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rental credit application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out rental credit application

How to fill out rental credit application?

01

Gather all necessary documents such as identification, proof of income, and previous rental history.

02

Carefully read and understand the application form before filling it out.

03

Provide accurate and complete information about your personal details, employment history, and financial information.

04

Attach any supporting documents required by the application, such as bank statements or reference letters.

05

Double-check your application for any errors or missing information before submitting it.

06

Submit the completed application along with any application fees to the landlord or property management company.

Who needs rental credit application?

01

Individuals who are seeking to rent a property from a landlord or property management company.

02

Anyone who wants to provide a comprehensive overview of their financial and rental history to increase their chances of being approved for a rental property.

03

Landlords or property management companies who require potential tenants to complete a rental credit application to assess their eligibility and determine if they meet the necessary criteria for renting a property.

Fill form : Try Risk Free

People Also Ask about rental credit application

Does your credit score go down when applying for an apartment?

What's the lowest credit score a landlord will accept?

What can be used as a credit reference?

Do rental credit checks affect credit score?

Are apartment credit checks hard inquiries?

Which credit score do landlords look at?

What is a credit account on a rental application?

What is a good credit score for renting?

What is credit balance on rent portal?

Can I rent with a 650 credit score?

Can I rent with a credit score of 580?

What is the lowest credit score to rent?

What does credit rent mean?

When rental companies check credit does it affect credit score?

Can you get a rental with a 500 credit score?

What credit score should I require for rental?

What's the lowest credit score to rent an apartment?

Can I rent with a 600 credit score?

How do you fill out a credit reference?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is rental credit application?

A rental credit application is a form used by landlords to assess the creditworthiness of an applicant when they are considering renting a property. The application requests basic information about the applicant, such as name, address, employment information, and financial information. The application is then used to check the applicant’s credit history, which can help determine whether they are a good financial risk for the landlord.

What is the purpose of rental credit application?

The purpose of a rental credit application is to provide a landlord with information about a potential tenant's credit history, employment history, and other information to help the landlord decide whether to approve or deny the tenant's application for rental housing. It also helps the landlord determine the amount of a security deposit to charge the tenant, if any.

What information must be reported on rental credit application?

1. Full name

2. Current address

3. Previous address

4. Phone number

5. Email address

6. Date of birth

7. Social Security number

8. Employment information

9. Source of income

10. Length of time at current job

11. Bank account information

12. Credit references

13. Rental and credit history

14. Any additional information requested by the landlord

When is the deadline to file rental credit application in 2023?

The deadline to file rental credit applications in 2023 will depend on the specific application and the rental provider. Generally, applications for rental credit should be filed as soon as possible to ensure that you are approved in time.

What is the penalty for the late filing of rental credit application?

The penalty for the late filing of a rental credit application will vary depending on the landlord and the rental agreement. Some landlords may choose to impose a late fee or to deny the application altogether. It is important to review the terms of the rental agreement prior to submitting the application, as the penalty for late filing may be stated there.

Who is required to file rental credit application?

Typically, individuals who are interested in renting a property are required to file a rental credit application. This includes potential tenants who want to lease an apartment, house, or any other type of rental property. The purpose of the rental credit application is for landlords or property management companies to assess the creditworthiness and reliability of potential tenants before entering into a rental agreement.

How to fill out rental credit application?

1. Gather the necessary information and documents: Before starting the application, collect all the required information and supporting documents. This may include your personal details, employment history, contact information for references, and financial information such as income and expenses.

2. Read and understand the application: Carefully review the entire rental credit application to understand the questions being asked, any instructions or guidelines provided, and any additional documents that need to be attached.

3. Personal information: Start by providing your personal details such as full name, date of birth, social security number, and current address. Make sure to enter this information accurately.

4. Employment information: Fill in your employment history, including the names of employers, job titles, dates of employment, and monthly income. If you have multiple jobs or sources of income, provide information for each one.

5. Financial information: You'll likely be asked to provide details about your monthly income, debts, and expenses. This may include information about any loans, credit card balances, or monthly bills. Be honest and accurate when providing this information.

6. References: Usually, the application will require you to provide a few references, such as previous landlords or personal contacts who can vouch for your character and reliability. Include their names, contact information, and how they are related to you.

7. Authorization and signatures: At the end of the application, you may be required to sign a consent form giving permission to the landlord or property manager to access your credit report or conduct a background check. Review this section carefully and ensure you understand what you are consenting to before signing.

8. Review and attach supporting documents: Check all the details you have entered for accuracy and completeness. Then attach any necessary supporting documents, such as proof of income, bank statements, or identification copies, as specified in the application requirements.

9. Submit the application: Once you have finished filling out the application and attaching the required documents, follow the instructions for submitting. It is typically submitted either online, through email, or in person at the rental property office.

Remember to keep a copy of the completed application and supporting documents for your records.

How can I modify rental credit application without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your rental credit application into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send rental credit application to be eSigned by others?

Once your rental credit application is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I sign the rental credit application electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your rental credit application in minutes.

Fill out your rental credit application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.